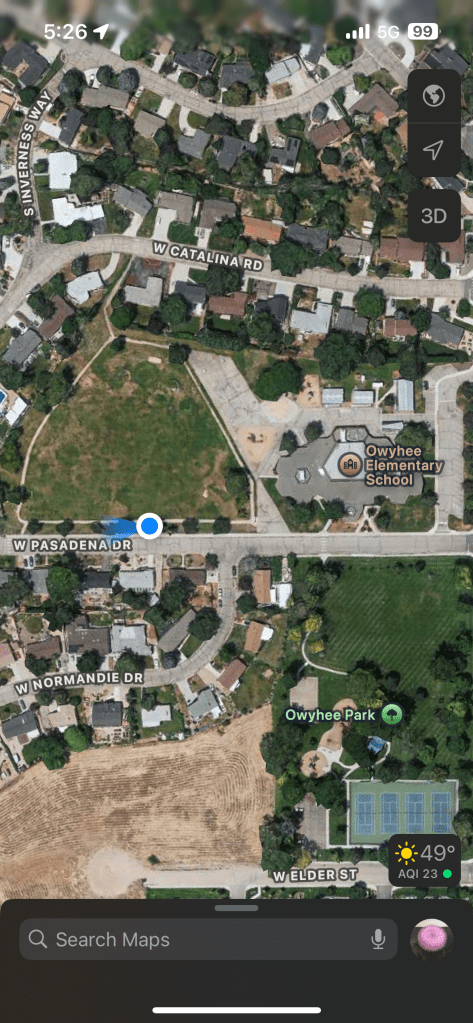

Owyhee Elementary School

Run Time: 64:35 + 2-minute kick

Another revisit to a favored locale. Same hotel, same school a few blocks away. The track is short, the elevation flat, the scenery not particularly spectacular, but it is a safe and known route, and elementary schools are nostalgic places. They remind you of a time in your life when the field off the playground seemed expansive and endless, when being outside happened every day, when threats and thrills were physical, not conceptual.

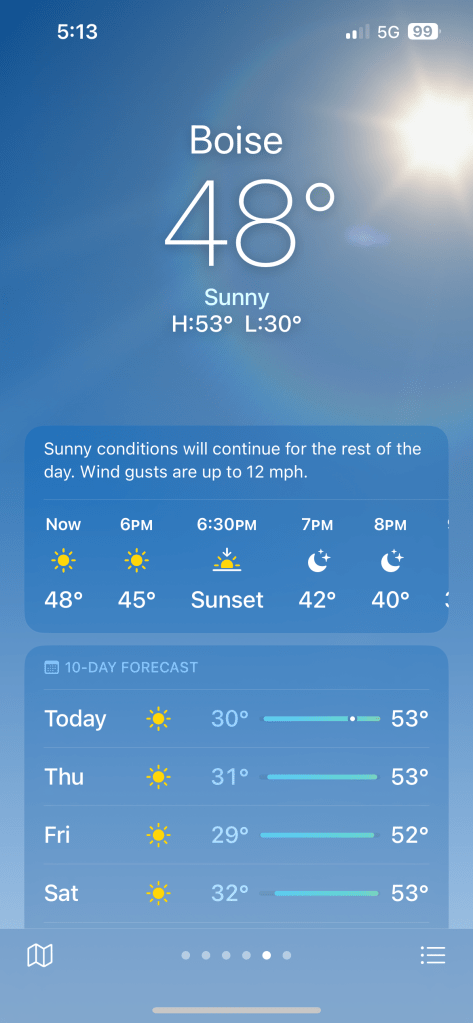

This schoolyard has become a defacto dog park, and the dogs came out in droves as I ran, at least 10 different dogs, with around 7 different humans. The dogs were all remarkably well-behaved. I heard no barking, and no dog interrupted my run, and I witnessed no tense dog-to-dog encounters. Some were clearly elated to be in an open space, with frisbees and balls to chase. The sun was out, and spirits were high.

When the sun is out, and spirits are high, and nostalgia is brewing, my thoughts wander to topics like usury. Usury is currently defined as the practice of making loans that unfairly enrich the lender. Payday loans and high-interest credit cards come to mind. I would also lump in the practice of applying penalty fees for overdrafts, or something similar. Now that credit cards can be debit cards attached to a checking account, think of the entrapment philosophy that allows you to make a purchase when insufficient funds exist in your account, just so that a $30 overdraft fee can be charged. Why not just decline the transaction? Why not, indeed.

The original definition of usury, however, included the charging of any interest or any fee for the use of money. The churches regulated such practices at the time, albeit loosely, and Christian, Jewish, and Islamic societies all at least discouraged usury. Charging interest was, at times and in places, a sin. The idea was that loaning money was a partnership. If you loaned money, you were investing in a venture of some kind, for which you might benefit financially IF the venture proved profitable. Also, it meant that you assumed risk. If the venture lost money, you lost money. This system promoted the practices of careful consideration, thoughtful assistance, and shared responsibility, on the part of both lenders and borrowers. A far cry from the selling of mega-batches of mortgages before the ink dries on the 50 pages of title paperwork. And all of this happened with no interest charges or fees.

Now, I am not a big fan of organized religion, but (or maybe as a result) I am not above aligning myself with their position when it’s convenient, and by convenient I mean when I am in agreement and it helps my argument. Here is a list of great thinkers whom Wikipedia says denounced usury: Moses, Plato, Aristotle, Cato, Cicero, Seneca, Acquinas, Buddha, and Muhammad. Not all religious thinkers, thankfully, but some big ones. I have to think Jesus should be on the list also, given his purported money-lender-table-turning-in-the-temple incident.

I can see how banks were important when gold or cash were the common currency. Not so much anymore, in the digital age. Plus, without banks, how could we ever have had a movie like Butch Cassidy and the Sundance Kid? Butch: “What happened to the old bank? It was beautiful.” Bank Guard: “People kept robbing it.” Butch: “Small price to pay for beauty.”

The modern Financial industry makes nothing. It invents schemes to make money at the expense of another. It adds nothing of value to the economy or to the community. It feeds off manufacturing/technology/service/science and other legitimate industries. It is a cesspool of scheming and system-gaming and deceit and connivance, and we are all in it up to our eyeballs and would have one hell of a time extracting ourselves from it at this point. It is full of good people doing good work and genuinely trying to help other people, built on a zero-sum foundation of gaining an advantage at the expense of another. And it all started with usury, when we first said, “Sure, I’ll help. At a cost.”

I get it. Banks have to make money to operate, but what if all banks were non-profit, and what if all bank employees were paid commensurately to the work they did? What if all investment truly had risk? What if the only way to create a retirement or passive income were to earn money and save it? Or, if we really want consumerism, what if we all received a universal basic income? As technology makes more jobs obsolete, why not just give people money to spend? Are we really okay with robber barons cheating us to become rich, but we don’t want tax money to go to the lonely incel guy with a bad back? Maybe a little spending money will improve his outlook.

Wealth = power. Usury is a tool of the wealthy. With a tool like usury, both wealth and power centralize and increase, like compound interest. It’s a bad thing. We don’t need it, just like we don’t need mortgage-based securities, or credit default swaps, or stock markets, or mixed derivatives. And God help us if we have to rely on religion to save us from ourselves.